Small business loan program expands with PayPal, Square, Intuit

A number of fintech companies can participate in the Paycheck Protection Program

A number of fintech companies -- many of them household names -- can now participate in the federal government's Paycheck Protection Program, and that is good news for scores of small business owners who might not have existing relationships with larger banks which have prioritized that in accepting applications so far.

Square, PayPal and Intuit are among a group of non-traditional lenders the Small Business Administration has now approved to participate in this $350 billion program which provides government-backed, low interest, forgivable loans to rescue small businesses crushed by the novel coronavirus' economic impact.

This comes as the PPP is nearly out of cash and is still plagued by problems, including some that still exist with SBA's online loan application portal used by all lenders known as E-Tran, which was down on Monday, according to a banking industry source. The SBA denied this to ABC News on Monday, with spokeswoman Jen Kelly saying, "E-Tran is running and doing billions of dollars in loans."

White House economic adviser Larry Kudlow, over the weekend, said in a Fox interview that the program was estimated to run dry by Friday, and Congress is still squabbling over funding.

It's unclear what the influx of lenders and demand on an already-over-burdened system might mean; still, demand for the program is high, according to these non-traditional lenders which lobbied Congress to be included in the PPP, and many intend to help the little guy, already counted among their clientele.

PayPal, which serves more than 10 million small businesses in the U.S., has started accepting applications, and according to spokesman Joe Gallo, has already funded some loans, though it would not disclose further details.

The company is prioritizing existing customers, though not ruling out opening the door to others.

"At this time we are focused on our more than 10 million U.S. small business customers. We continue to monitor the situation and update as needed," Gallo told ABC News.

Gallo also said that his company's participation in the program would mean that much-needed aid would flow to underserved communities that he called "banking deserts" -- counties where banks have closed since the 2008 financial collapse.

Tune into ABC at 1 p.m. ET and ABC News Live at 4 p.m. ET every weekday for special coverage of the novel coronavirus with the full ABC News team, including the latest news, context and analysis.

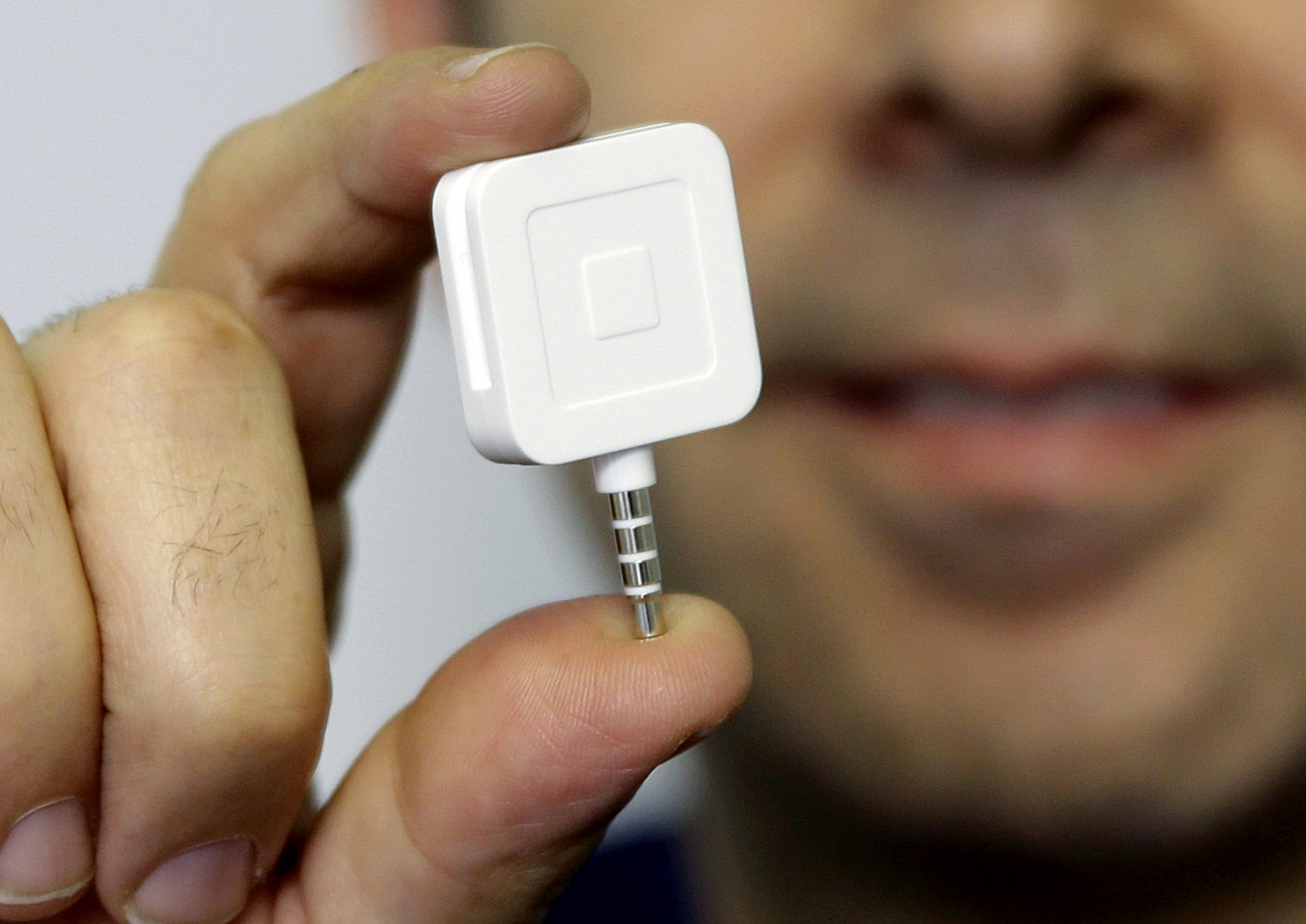

Square -- which has millions of sellers globally, with most in the U.S. -- plans to start taking applications this week, according to spokeswoman Katie Dally who told ABC News that the company sees this as a huge opportunity to help sole proprietors and independent small business owners.

Though the company will eventually be open to all small businesses, Square has planned a "rolled out application launch," prioritizing existing customers who can easily auto-populate forms, like payroll for those who use Square Payroll.

"We can easily port data for those people, so it will go much faster," Dally said. "We do expect high demand. We've been working with our seller base since April 3."

Both Square and PayPal partner work in partnership with banks, Celtic Bank and WebBank, respectively.

Intuit said its Quick Books Capital program would be able to "simplify, automate and expedite the PPP application and funding process."

"We are focused on getting help to customers as quickly as possible as they navigate this unprecedented and challenging time," said Alex Chriss, EVP and GM of QuickBooks.

Like Square and PayPal, Intuit said it would prioritize existing customers, as well.

"PPP federal relief processing will initially be available for a subset of QuickBooks Online Payroll customers who will be able to begin applying as early as next week," the company announced on Friday.

"Validation of payroll information is necessary to complete the PPP application. For QuickBooks Payroll customers, the customers’ data is already in the QuickBooks system. As a result, we are well positioned to help expedite the loan application process for this group. One in 12 American workers are paid through our payroll systems, which makes this an impactful place to start," said Luke Voiles, VP and Business Leader of QuickBooks Capital.

As of this weekend, Kudlow said PPP had seen some 661,000 loans approved totaling $168 billion. Neither the SBA nor the Treasury Department would say how much money had been disbursed.

"Those are enormous numbers. That’s one reason, by the way, our estimates are we’re going to run out of money for the small business thing April 17th," he said. "That's why we would like the Congress to help us with an additional $250 billion."

There is little to no disagreement over whether or not to increase PPP by that amount, the question remains, can Democrats and Republicans come to an agreement on whether to fund other programs and urgent needs now or save those for the next, all-but-certain stimulus package.

ABC News' Sarah Kolinovsky contributed to this report.

What to know about coronavirus:

- How it started and how to protect yourself: coronavirus explained

- What to do if you have symptoms: coronavirus symptoms

- Tracking the spread in the US and Worldwide: coronavirus map